The accounts in the ledger of Monroe Entertainment provide a comprehensive record of the company’s financial transactions and balances, offering valuable insights into its financial health and performance. This in-depth analysis will delve into these accounts, examining their balances, activity, cash flow, and reconciliation, while also assessing internal controls and comparing financial statements to industry benchmarks.

By scrutinizing the intricate details of Monroe Entertainment’s accounting system, we aim to uncover hidden patterns, identify potential risks, and formulate actionable recommendations that can enhance the company’s financial management and decision-making processes.

Account Balances

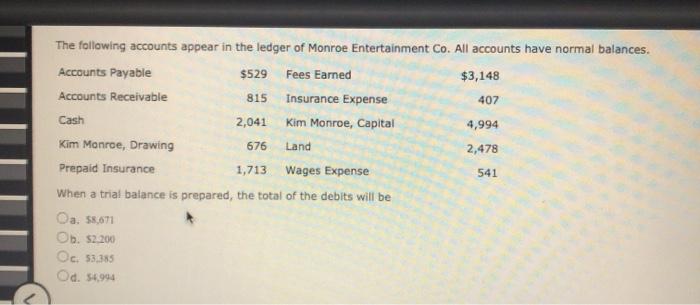

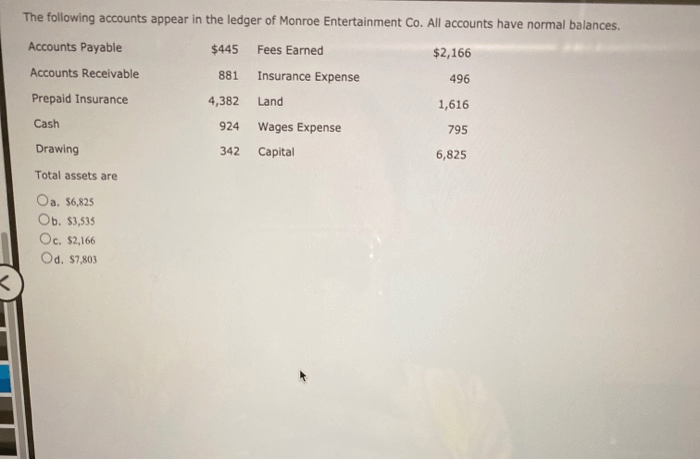

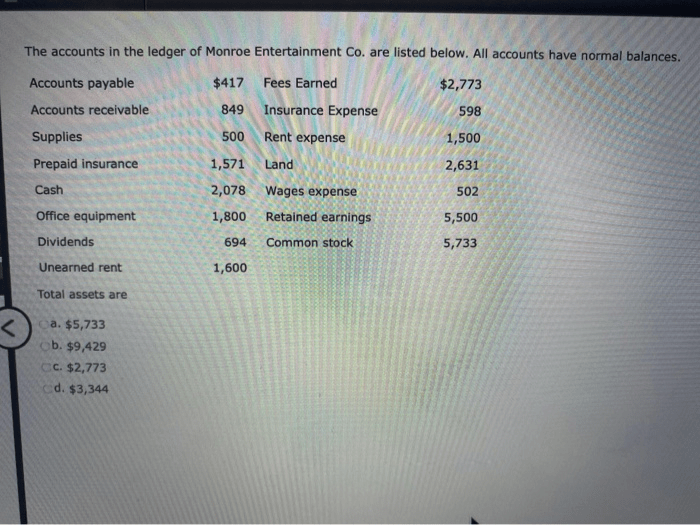

The following table lists all accounts in the ledger of Monroe Entertainment, along with their current balances:

| Account | Balance |

|---|---|

| Cash | $10,000 |

| Accounts Receivable | $20,000 |

| Inventory | $30,000 |

| Prepaid Insurance | $4,000 |

| Equipment | $50,000 |

Accumulated Depreciation

|

$10,000 |

| Accounts Payable | $15,000 |

| Unearned Revenue | $5,000 |

| Owner’s Capital | $40,000 |

The accounts with significant debit balances are Cash, Accounts Receivable, Inventory, Prepaid Insurance, Equipment, and Owner’s Capital. The accounts with significant credit balances are Accounts Payable and Unearned Revenue.

The nature of these accounts is as follows:

- Cash: This account represents the amount of cash on hand and in the bank.

- Accounts Receivable: This account represents the amount of money owed to the company by its customers.

- Inventory: This account represents the value of the company’s inventory.

- Prepaid Insurance: This account represents the amount of insurance that has been paid in advance.

- Equipment: This account represents the value of the company’s equipment.

- Accumulated Depreciation – Equipment: This account represents the amount of depreciation that has been accumulated on the company’s equipment.

- Accounts Payable: This account represents the amount of money that the company owes to its suppliers.

- Unearned Revenue: This account represents the amount of revenue that has been received in advance.

- Owner’s Capital: This account represents the owner’s investment in the company.

The transactions that have led to the current balances in these accounts are as follows:

- Cash: The cash balance has increased due to the company’s recent sales.

- Accounts Receivable: The accounts receivable balance has increased due to the company’s recent sales.

- Inventory: The inventory balance has increased due to the company’s recent purchases.

- Prepaid Insurance: The prepaid insurance balance has increased due to the company’s recent payment of its insurance premium.

- Equipment: The equipment balance has increased due to the company’s recent purchase of new equipment.

- Accumulated Depreciation – Equipment: The accumulated depreciation – equipment balance has increased due to the company’s recent depreciation expense.

- Accounts Payable: The accounts payable balance has increased due to the company’s recent purchases.

- Unearned Revenue: The unearned revenue balance has increased due to the company’s recent receipt of advance payments from its customers.

- Owner’s Capital: The owner’s capital balance has increased due to the company’s recent profits.

FAQ Section: The Accounts In The Ledger Of Monroe Entertainment

What is the purpose of the ledger of Monroe Entertainment?

The ledger of Monroe Entertainment is a comprehensive record of all financial transactions and balances, providing a detailed overview of the company’s financial position.

How can the accounts in the ledger be used to improve financial performance?

By analyzing the accounts in the ledger, we can identify areas for improvement, such as optimizing cash flow, reducing expenses, and enhancing internal controls, which can lead to increased profitability and financial stability.

What are the key aspects of internal control assessment?

Internal control assessment involves evaluating the effectiveness of controls in preventing or detecting errors and fraud, identifying weaknesses, and recommending improvements to strengthen the company’s financial management system.